Did you know that title insurance is almost exclusively an American business?

In most industrialized countries, governmentally mandated land registries largely eliminate the potential for confusion over property ownership.

Why doesn’t the United States maintain a federal land registry? Poor planning? Rugged individualism? Who knows?

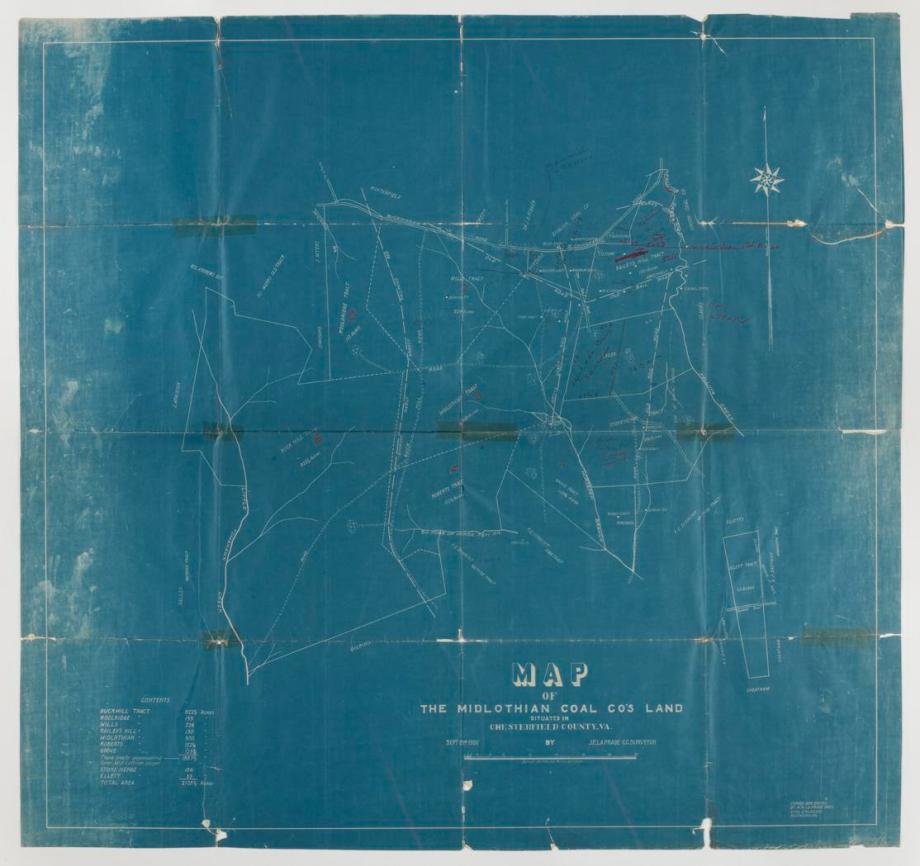

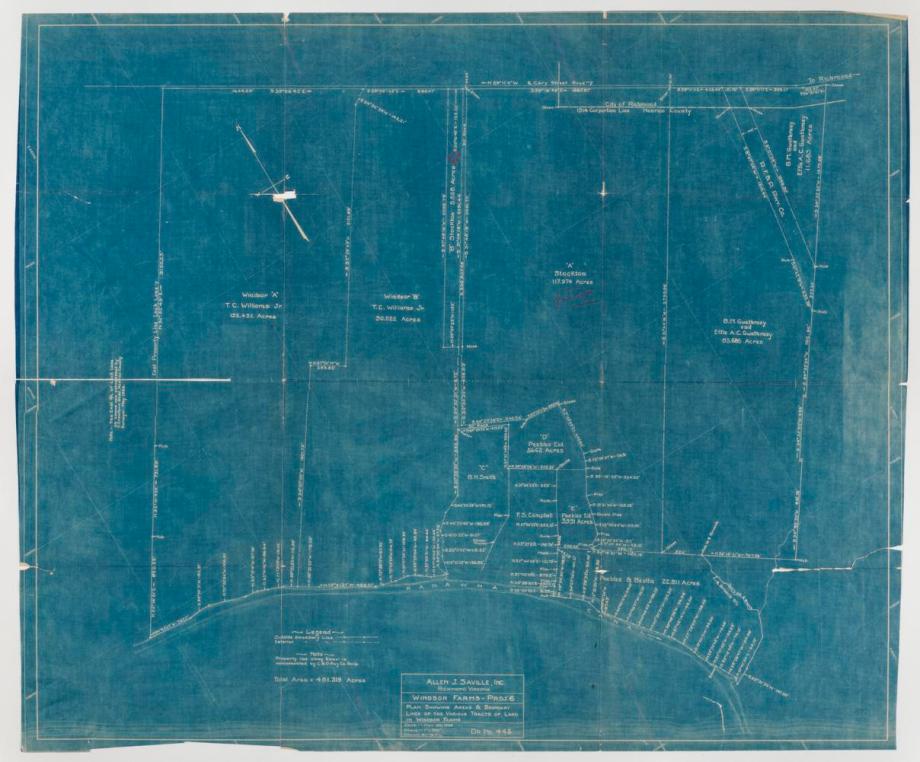

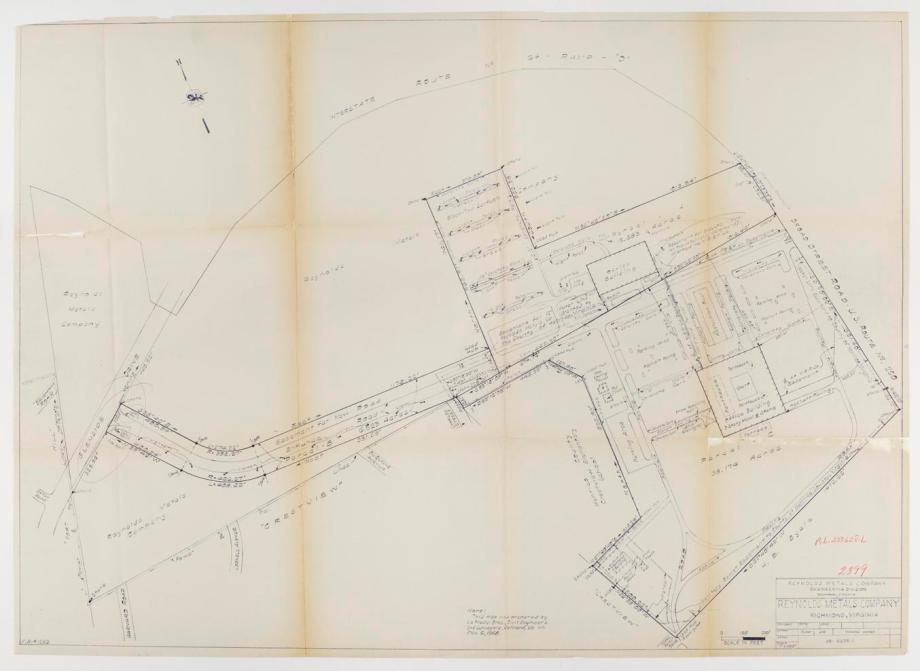

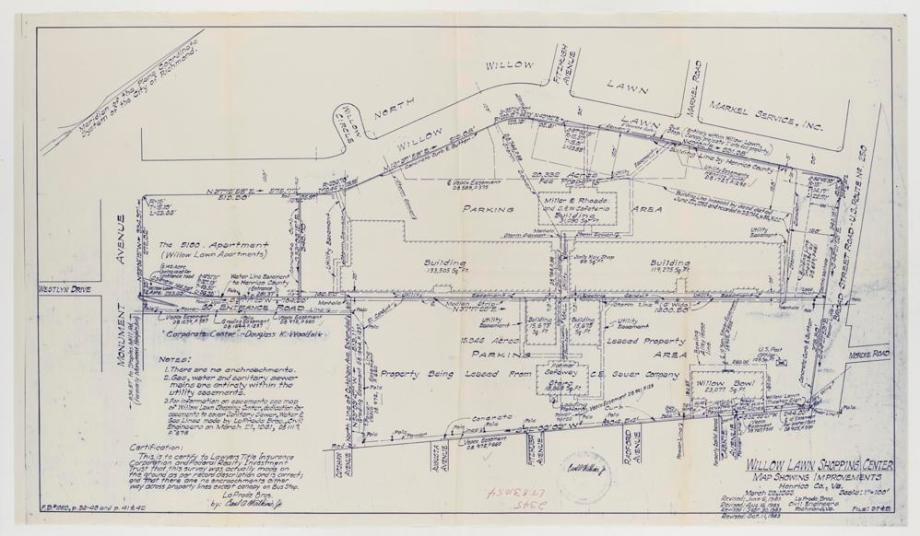

What we do know is that before the invention of title insurance, real estate transactions in the United States could get quite messy. In order for ownership to be conveyed from one person to another, titles had to be checked for validity, meaning that there were no outstanding claims on the property. Although this task was undertaken by real estate lawyers, they could not be held liable for errors made by their own negligence. If a previously approved title was later deemed invalid, it was the buyer of the property who would lose his investment. Because many properties had complicated histories of mortgages and liens, such errors occurred frequently.